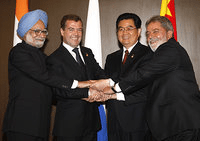

It has been a rough go for the dollar of late. The global financial crisis coupled with concerns about soaring U.S. deficits have caused several of the world's major holders of American debt to question the greenback's continued role as the leading international reserve currency. Roughly one-third of the U.S. Treasury debt held by foreign countries lies in the BRIC economies -- Brazil, Russia, India, and China -- who met in Yekaterinburg, Russia, on Tuesday for the group's first full-format summit.

Ultimately, the meeting did not result in what some had speculated: a specific call for a shift away from dollar assets. Instead, the group only managed a weak statement on the global currency system, revealing a potential gap between Moscow and Beijing's positions.

BRIC consists of the world's fastest emerging economies, which together represent 42 percent of the world's population, 25 percent of global land coverage, and 15 percent of global GDP. Among the group are two of the world's manufacturing powers -- China and India -- and two major resource providers -- Brazil and Russia. While in many respects their political and economic interests diverge greatly, they are united by one common goal: Each wants a bigger say in how the global economy of tomorrow will operate.