As a former World Bank official, Columbia University academic and Afghan minister of finance, newly elected Afghan President Ashraf Ghani faces high expectations to turn his country’s war-torn economy around. Having actually written the book on fixing failed states, he now faces the challenge of putting theory into practice. Ghani’s deep skepticism of the merits of foreign aid and extractive industries positions him well to avoid the pitfalls of putting either at the economy’s helm.

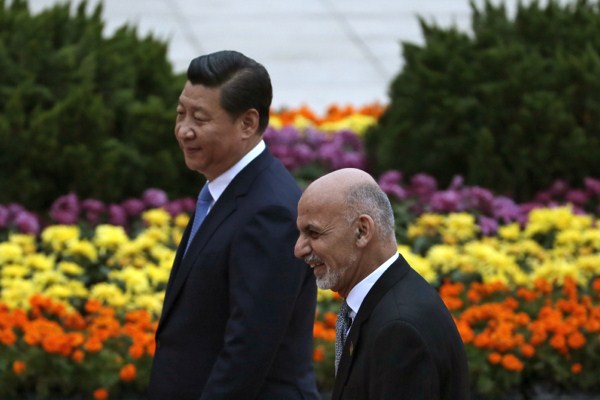

While aid levels will likely decline as foreign troop numbers continue to dwindle, Ghani’s real challenge will be nurturing Afghanistan’s fragile minerals sector while managing domestic and international expectations of its ability to be an immediate driver of growth. That was a priority as he began a trip to China on Tuesday, where he plans to attract more Chinese investment, especially in Afghan mining. Ghani quickly signed a series of economic and technical cooperation agreements with Chinese President Xi Jinping and announced hopes for a transportation link between eastern Afghanistan and western China. Yet the current security challenges facing the Afghan mining sector may still quiet advocates of resource-led growth long enough for Ghani to bring other sectors to the fore.

Afghanistan’s mineral reserves include iron, copper, hydrocarbons and other industrial raw materials valued as high as $3 trillion. Renewed interest in the sector in 2011—after the “discovery” of $1 trillion worth of mineral reserves that merely revealed publicly what many in the region have long known—conveniently provided the international community with a narrative of hope for repairing Afghanistan’s devastated economy at a time when Western troop withdrawal was on the horizon.