In late July, State Grid Corporation of China—the world’s largest state-owned electric utility company—bought a 35 percent stake in Italy’s CDP Reti for $2.8 billion. CDP Reti, itself a state-owned energy holding company, has its own 30-percent controlling stake in the Italian natural gas giant Snam and power grid company Terna, giving the Chinese company major interests in Italy’s energy market. State Grid’s Italian purchase added to a portfolio that includes a 25 percent stake in Portugal’s REN, which controls the two main Portuguese power grids. The purchases were the latest sign that Europe has become a battlefield for China, though Beijing, of course, is not putting boots on the ground. Rather, it is buying up prized assets throughout the continent, most of all in the energy and infrastructure sectors.

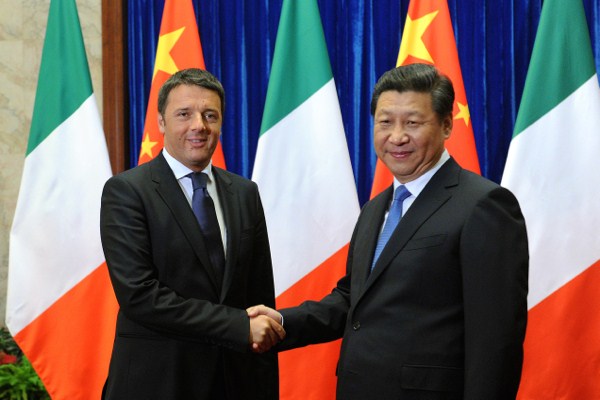

The Sino-Italian partnership has strengthened over the past year, with Beijing securing minority stakes in Italy’s state-controlled energy companies ENI, ENEL and Ansaldo Energia. Like many other debt-ridden countries within the European Union, Italy is opening its strategic assets to Chinese investors to slash its huge sovereign debt, which topped $2.8 trillion in June. And like other European economies struggling to recover from the 2008 global financial crisis, Italy hopes to get cash infusions from Beijing while gaining space in China’s vast market for its export-oriented small- and medium-sized enterprises.

As Chinese exports to Europe are on a downward trajectory, China’s foreign direct investments in the EU are steadily growing. They were worth $11.9 billion in 2012, more than twice as much as the previous year.