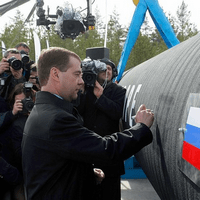

The Nord Stream natural gas pipeline has the potential to deliver much of northern Europe's natural gas requirements from a reliable source in Siberia to the German coast. It is one of Russian energy giant Gazprom's best-planned and most-ambitious projects, involving a consortium of construction firms around the Baltic region and investors from Europe's major energy firms. Yet when the first of the project's two planned pipelines through the Baltic Sea was completed in May, it became apparent that Nord Stream's cost was much higher than originally projected. Though the impact will be felt by all of the project's European partners, Germany will be especially vulnerable to the project's potential financial complications.

It is an optimistic time for investors in the Russian gas industry, as European demand could hardly be higher, while Middle Eastern and African sources are becoming less reliable. The Libyan conflict continues to place access to that country's fields in doubt. Meanwhile, Algeria's output fell in 2010, with predictions that rising domestic demand and nearby African energy needs will combine to further reduce export capacity to the European Union in the next few years. Tunisian supplies, such as the Transmed pipeline to Italy and Slovenia, have weathered political instability, but they offer significantly less natural gas supply than any of Gazprom's projects and do not address Northern European demand. At the moment, then, there is no clear alternative to Russian natural gas supplies on the scale at which Gazprom promises to deliver.

But the rising costs of Nord Stream pose an economic risk. The major national investors, including Germany's BASF and Ruhrgas, the Netherlands' Gasuunie and France's GDF Suez, have ensured high initial levels of project safety standards. But even small cost increases -- from construction and initial maintenance to environmental clean-ups -- will affect German businesses and the German government more than other Western European partners in the pipeline project. Germany, the largest European market for Russian energy, is twice as dependent on Russian natural gas as France, and plans to phase out nuclear power in the wake of Fukushima will only increase demand for Russian natural gas for heating due to decreased electricity supplies. The worst days of winter in 2010 demonstrated how much German consumers rely on Russian supplies for heating. So while all of Central and Western Europe have supplies to gain from the success of Nord Stream, Germany's energy sector and overall consumer market is more tied to the project's success than are France or Sweden, which are also investors in the pipeline.