Learn more about the impact of the Global Financial Crisis on global economic governance, and where we are now, when you subscribe to World Politics Review today.

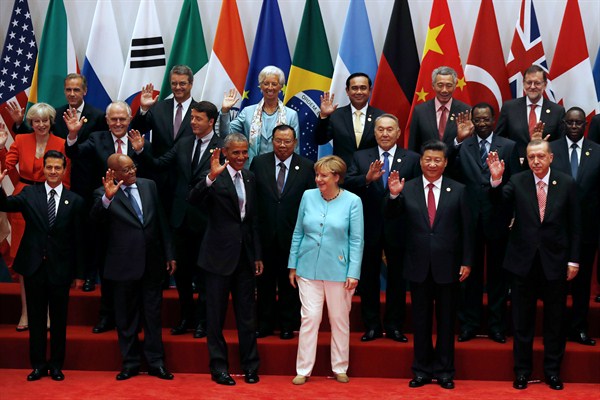

As a result of the Global Financial Crisis, management of the global economy was broadened from a core of developed Western countries to a broader Group of 20, or G-20, comprised of the world’s 20 largest economies. The G-20’s emergence began when the onset of the financial crisis prompted the elevation of what had previously been a modest and little-reported meeting of finance ministers and central bank governors to a much more prominent meeting of the heads of state of the world’s most important economies. Given the inclusion of the BRICS and other key developing economies, as well as a sample of middle and regional powers, in the G-20’s membership, the group’s battlefield promotion was a powerful symbol of a changing international economic order. This upgraded version of the G-20 then proceeded to get off to a strong start with its first three summits in Washington, London and Pittsburgh, adopting measures that avoided the worst-case scenarios of protectionist trade wars that can easily follow a global downturn. Optimists began to imagine a new era of global economic governance.

But over time, the G-20’s crisis management record was more harshly criticized. Old divisions, along with some new ones, surfaced among the group’s members. Increasingly, optimism was replaced by widespread pessimism about the ability to deliver any kind of effective international cooperation at all. According to this worldview, the shift to a more multipolar world has the left the global economy with a dangerous leadership vacuum, an “empty driver’s seat” or a “G-zero.”

What is the real verdict, and what does it say about future cooperative management of the global economy?

To learn more about the G-20’s record in responding to the Global Financial Crisis, read G-Hero or G-Zero: Global Economic Governance After the Crisis for FREE with your subscription to World Politics Review.

[marketing]ofie[/marketing]

Reforms to the International Order Didn’t Survive the Global Financial Crisis

With the Global Financial Crisis now safely in the past, the sense of urgency that drove the initial reactions to it have subsided. Policymakers in virtually every major country have pivoted away from discussions of international cooperation and institutions to focus on domestic issues. The Trump administration is merely the most pronounced example of this trend with its “America First” focus. The financial crisis made leaders realize that they had to work together globally to defend their interests. In the age of Trump, their successors are far more interested in satisfying populists at home than their counterparts in the G-20.

To learn more, read Why Reforms to the International Order Didn’t Survive the Global Financial Crisis for FREE with your subscription to World Politics Review.

Could There Be a Repeat?

Late last summer, things once again began getting messy as global investors soured on Argentina, Turkey and Indonesia, among other emerging market economies, causing their currencies to crash. As troubles developed in one country after another, some observers were careful to point out that the causes of the individual economic crises are very different. Don’t jump to the conclusion that the crises are becoming contagious, they argue. Turkey is not the same as Argentina, just as Indonesia’s problems are distinct from India’s issues. The fundamental insight of this argument—to not oversimplify complex events—is both important and correct. These cases are distinct in many key ways. Yet it is impossible to understand the challenges facing emerging markets today in isolation from one another. The nature of the global financial system, within which their national financial systems are embedded, constrains governments’ ability to fully control the fate of their own economies. Their fortunes are not completely independent of one another. Three important facts about global finance can help explain why this is the case.

To learn more, read Are Emerging Market Jitters the Sign of Another Looming Economic Crisis? for FREE with your subscription to World Politics Review.

[marketing]ofie[/marketing]

You can learn all about the global financial crisis’s impact and legacy and a wide variety of other global issues in the vast, searchable library of World Politics Review (WPR):

- The G-20’s record in response to the global financial crisis, in G-Hero or G-Zero: Global Economic Governance After the Crisis

- How the crisis shifted economic power and influence to non-Western economies, in The Global South and Financial Governance

- Whether China’s rise represents a boost or a challenge to the global economic order, in New Order: China’s Challenge to the Global Financial System

- Why international cooperation frayed once the crisis subsided, in Why Reforms to the International Order Didn’t Survive the Global Financial Crisis

- Why financial crises remain highly contagious, in Are Emerging Market Jitters the Sign of Another Looming Economic Crisis?

[marketing]boilerplate[/marketing]

Editor’s Note: This article was first published in July 2018 and is regularly updated.