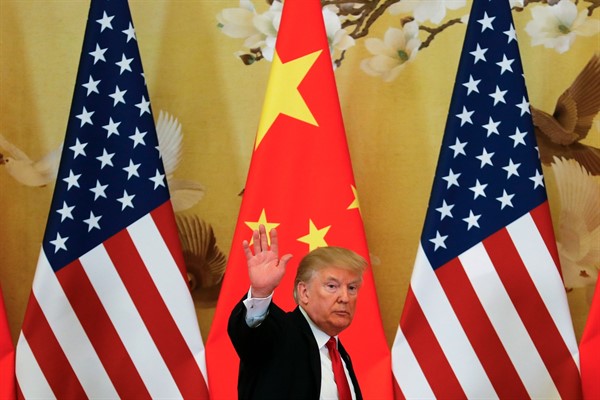

The global economic map is reshuffling, and predictions abound on where the pieces will land. As companies scramble to protect themselves from U.S. President Donald Trump’s trade wars, the growing technology rivalry between the United States and China, and the disruptions caused by the COVID-19 pandemic, will the long-promised “reshoring” of manufacturing back to higher-wage countries finally take place? Will the U.S. and China “decouple” their economies, particularly for the technologies of the future? If so, how will Europe, Japan and others respond?

For the moment, the big winner is uncertainty. We have moved from a world in which companies and their customers knew the rules of the game of global commerce, to one where many decisions are fraught with risk. Now, on top of the usual uncertainty inherent in predicting economic or consumer trends, companies face added political, legal and medical uncertainties that will inevitability discourage risk-taking, dampen investment and harm economic growth. Some companies will respond better than others to that uncertainty—and perhaps profit handsomely in the process. But many others will be faced with all but impossible choices.

The larger consequences for the global economy will depend a great deal on the actions of governments, especially the most powerful, like those of the United States and China. If they treat the world economy as a zero-sum competition—one in which both economic gain and national security are at stake—then the uncertainty will be magnified and the costs will escalate. If they can find ways to cooperate in managing the transition to whatever new economic order emerges after the pandemic, then the disruptions should be manageable. So far, though, the signs are not encouraging.